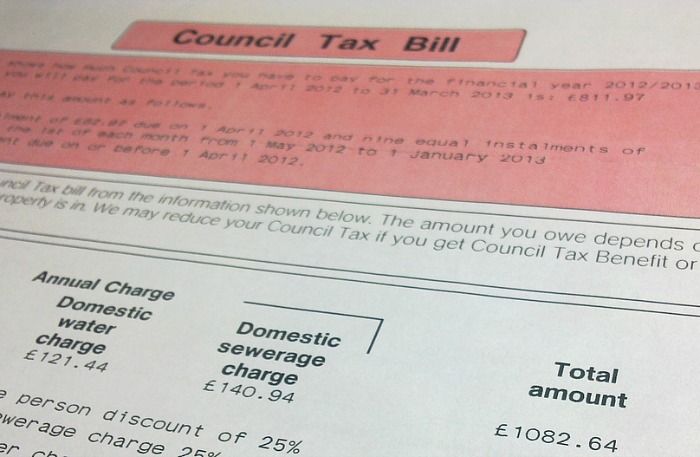

More than £20 million of Council Tax has not been collected by Cheshire East Council in the past three years, we can reveal.

Figures obtained under FOI shows there is a staggering £20.8 million of outstanding Council Tax debt from the years 2019-20, 2020-21 and 2021-22.

Ironically, it comes as Cheshire East Council bosses claim a current £20million “gap” in funding could mean further cuts to services in 2023-24, and a 4.99% rise in bills from April.

Our FOI figures show more than £5m (£5,986,012) is still not collected from 2019-20, more than £7m (£7,706,863) not collected from 2020-21, and more than £7m (£7,071,603) uncollected from 2021-22.

And there is likely to be millions of pounds owed from earlier years.

Figures also show that, as of December 31 2022, there are still 13,127 individual tax accounts in arrears from 2021-22, as well as 6,171 from 2020-21, and 4,642 from 2019-20, before Covid’s impact.

And in the last three financial years, the authority has had to “write off” more than 3,000 accounts without taxes collected – including nearly 2,000 from 2019-20, before Covid.

In the Nantwich CW5 postcode alone, £332,990 in council tax is owed from the 2021-22 year.

The uncollected amount of £7 million in 2021-22 is equivalent to just under 3% of total revenue expected from council tax.

Cllr Janet Clowes, Conservative Group Leader in Cheshire East, said: “On the face of it, over £20m of uncollected Council Tax arrears over the past three years is scandalous – even more so when hard-strapped residents are being asked by the Labour-Independent administration to pay another maximum increase of 4.99% next year.

“But council finances are complicated and generally speaking, collection rates across the borough are high, with some Council Tax debts being recovered over longer periods.

“In the midst of a cost-of-living crisis, we know that some residents will experience difficulty in paying their bills on time.

“Nonetheless, a significant proportion of Council Tax debt (and arrears for other council services such as social care) are recoverable.

“That’s why debt collection must step carefully between legitimate recovery of debt, and sensitive support for those who are simply unable to pay. The Council Tax support scheme helps those in this position.

“But let’s be clear, for those who can pay but do not pay, it is the duty of this Labour-led administration to pursue collection of these monies robustly.

“This may mean recruiting a larger team to undertake this work, but in the current climate, this would be a worthwhile investment.

“After all, £20m is a phenomenal sum and every late bill paid, may help save the frontline services that the current budget consultation is proposing to slash.”

Cheshire East Council has defended its collection rates, claiming to be “high performing collection authority” but admitted that collection rates have “reduced” in the last three years.

Cllr Amanda Stott, chair of Cheshire East Council’s finance sub-committee, said: “The total quoted arrears of £20.8m should be set against the total amount billed over the same period – which is £854m.

“The council understands reasons for late payments, or none payment, for council tax each year, and budgets accordingly. These figures are within the expected levels that have been budgeted for, so it doesn’t affect our financial planning.

“The collection of arrears continues over several years, so that any potential impact is reduced over time. If you were to compare us to other similar councils, we are ranked number 11 out of 59 (unitary) councils for the highest in-year collection rate of council tax debts for 2021-22.

“Last year’s figures show that Cheshire East Council’s collection rate was at 97.4% – higher than the average for councils in England, at 95.7%, and for all unitary councils (95.8%).

“Cheshire East Council follows best practice in terms of collection of local taxes by applying a firm but fair process to those who avoid payment, while supporting those residents who have difficulty making payment.

“Our vulnerability process helps residents spread payments over longer periods of time and signposts to support agencies, where appropriate.

“Our collection rates over the last three years have reduced – but this is consistent with collection nationally. During this time, the government asked councils to cease debt collection during much of the pandemic.

“This has been followed by cost-of-living crisis, which has impacted many residents’ ability to maintain household payments.”

Support is available to those who need it with paying their council tax at www.cheshireeast.gov.uk/CouncilTaxSupport

I dealt with mortgage arrears during my career in Financial Services. I accept there are genuine cases, caused by illness, bereavement etc. However a figure of 20 million pounds over three years is not acceptable.

In the cases of home owners charging orders should be considered to ensure the debt with interest is paid. Council Tax support is there to support those entitled to benefits. Why should the good payers pay for those who decide not pay or fail to manage their financial affairs.

All cases should be monitored and controlled. Common Financial Statements should be obtained and those in arrears should be directed to debt specialist for example Citizen Advice.

The key is the methods, procedures and controls adopted by Cheshire East.

Mortgage, rent , council tax and energy bills have to be the first to be paid.

The route cause analysis is the key to this very serious issue together with how effective the management of the problem is.

Again the citizens of Cheshire East are only be given selective information of the problem.

There are many people who really struggle to pay their way and the rest of us should be tolerant, but excused non payment of council tax is a benefit and therefore should be means tested. If this is done, it would put the benefit given on an acceptable footing.

Statement – “This has been followed by cost-of-living crisis, which has impacted many residents’ ability to maintain household payments.”

We ALL face difficulty in paying our bills, it’s not a condition that affects only some households. Yet a lot of households PAY their bills. Wish I could offset my council tax commitment.

Staggering amount, none paid dept should be carried over to next years. Total amount owed plus interest is automatically paid to council on sale of property. Easy fix.

Hope the Council don’t write off those council tax arrears of £20 million and continue to retrieve that money, otherwise I will be asking for a reduction in my council tax bill at such time, as I struggle to pay my bill each year, yet do pay it.